Do you dream of financial freedom?

Of being debt-free? Of buying yourself a nice car or house, or of traveling the world?

Whether you want to live large and get rich or you just want the freedom to choose not to work so you can spend more time with family and loved ones, the secret lies within building income generating assets.

Over my last 7+ years as a successful entrepreneur and investor, I've learned a lot about what it takes to make money on your investments.

And I'd like to share that knowledge with you today so you can start building wealth and feel what it's like to no longer be a slave to a paycheck.

Here is how to build assets & get stupid rich (or at least how to not retire poor):

What is an Asset?

Already have a full understanding of assets and just want the juicy stuff? Click here to skip ahead.

Before I can teach you how to build assets, you first need to understand what they are. Many people THINK they understand assets — most are wrong.

An asset is anything you invest money into that gives you money back in return.

Earning money back on your investments in this way is called a positive Return on Investment (ROI).

For example, if I purchase a rental property and rent it out, I now own an income generating asset because my tenants are paying me more money in rent than I'm paying out on the property loan (hopefully).

Of course, not all assets are created equal. Some yield a very high ROI (for the sake of argument let's call anything over 10% a "high ROI"), some yield a low ROI (say 4%), and some may not yield an ROI or have a negative ROI (such as a rental property with no tenant, where you're losing money).

Anything you purchase that COSTS you money, rather than GAINS you money, is a liability. This is the opposite of an asset. Let's take a look at what that means:

What Common "Investments" are NOT Assets?

You may have heard that your house or your car is an "investment". While you can use your imagination to think of them as an investment — they do provide you with a safe place to sleep and a way to transport yourself — they are NOT assets.

When you purchased a house, you probably took out a mortgage. That mortgage has an interest rate. The interest rates on home loans is usually between 3 and 7%.

So if you buy a home for $100,000 on a 30-year loan, you'll end up paying $152,777.45. And that's on the lowest possible interest rate! At 7% you'll pay $240,508.90!

Meaning, if you buy a house, you LOSE tens, if not hundreds of thousands of dollars over the course of the loan. And that's not including utilities, repairs, upgrades, taxes, and seller fees if you decide to sell!

Oh, and did I mention that average inflation rate of 2% per year which means you have to earn at least 2% just to break even? (Read more about that here.)

This is a liability, NOT an asset. Of course they don't teach you that in college.

The only way a home or a car or anything else becomes an asset is if you can earn more from it than you spent on it. This means you could luck out and your house's value could go up enough over time to cover your interest or it could mean you make improvements that up the value.

But ultimately, unless you're extremely lucky or spent a lot of time researching up-and-coming neighborhoods to purchase your home, it is NOT an asset. Nor is your car (unless it's a Tesla with autopilot on the upcoming robo-taxi network).

11 Income Generating Assets to Invest In

Now that you understand what true income generating assets are, it's time to get started building assets! I've split this list into three areas:

- "Safe" Income Producing Assets

- "Risky" Income Producing Assets

- "Speculative" Assets

Let's dive in.

"Safe" Income Producing Assets

There are three assets considered to be "safe". Meaning, it's very unlikely you will lose money on any of these investments. Of course, no matter how safe an investment is, there is ALWAYS a risk.

Disclaimer: This is a good time to mention that I am NOT a financial advisor and this is not financial advice. I'm just sharing the information

I've learned over the years that has helped me succeed.

Additional Disclaimer: I personally view the following " safe assets" as borderline worthless in today's uncertain economy. The returns are just far too low and given the current political and economic climate, they seem to be just as risky, if not riskier, than the so-called "risky" assets.

Again, however, this is just my opinion and you must do your own research and do what's best for you! What do I know? I'm just some guy on the internet.

Now that that's out of the way, let's get to it:

Asset #1: Certificates of Deposit (CD’s)

Certificates of Deposit, or CDs, are basically you giving the bank a loan with interest over a set period of time (known as a "term length").

Most term lengths are between three months and five years. During this time, you can't take your money back without a penalty. However, you're guaranteed to get the agreed upon return.

The longer your term length, the more money you typically make.

However, CDs do come with a few drawbacks:

- Inflation: The average inflation rate in the U.S. over the past 60 years is 3.7%. And since the Fed printed over 30% of the U.S. money supply in the last year alone, inflation is likely going to skyrocket. Most CDs only offer a 0.5% to 3% return rate, which means you're more likely to lose money than gain it.

- Market Crash: The major risk here is a market crash like the Great Depression, which I believe is a very real possibility in the coming months or years. If the banks go kaput, you lose all your money.

- Money Tied Up: Because you can't touch your money for up to 5 years, you can't do anything with it. That's great if you're just looking to make a small, (probably) guaranteed return, but it also means you can't put your money into any other investments or use it at all for that time.

Overall, they are a no from me. But I am not your financial advisor and you need to make decisions based on what's right for YOUR personal situation.

Asset #2: Bonds

Bonds are just like CDs, except instead of lending money to a bank, you're lending it to the government. And like CDs, they are:

- Guaranteed Returns: Assuming the government doesn't collapse, you'll get your money back.

- Very Stable: You know exactly how much money you will get and when.

- Very Low Returns: Like CDs, you may not even be able to keep up with inflation and your money is tied up for a long time.

If you want a low-risk investment that you don't have to think about at all, bonds may be for you. Not for me, but maybe for you.

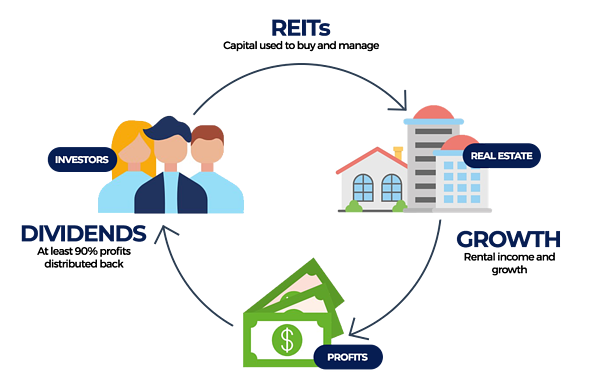

Asset #3: Real Estate Investment Trusts (REITs)

REITs were invented by the U.S. Congress in 1960 to give people the ability to invest in income producing real estate.

REITs are similar to a Mutual Fund but for Real Estate. They’re a collection of properties operated by a company (aka a trust) that uses money from investors to buy and develop real estate.

They're a great choice if you want to start investing in real estate but don't have the capital to make a big down payment and don't want the risk if anything goes wrong.

Like blue-chip stocks (more on those later), REITs pay out dividends. You get paid quarterly profits from the trust based on how much you own.

Plus, REITs have some tax benefits that other investments don't have.

Overall, REITs are the only "safe" income generating assets I would consider or recommend. They're a great way to get involved in real estate without tying up a ton of capital or taking on big risk.

You can purchase REITs through your online broker just like you can stocks or bonds. Exchange-traded Funds (ETFs) are probably the easiest choice, as they are like an index of the top-performing REITs.

"Risky" Income Producing Assets

Now that you know the so-called "safe" income generating assets, let's more into some of the slightly riskier (but often higher-paying) assets.

Note: I personally believe the following "risky" and "speculative" assets are the only ones actually worth investing in from this point forward unless you're an older investor with only a few years left to retirement.

This is because not only do they pay much higher returns, but most of them are also not actually much riskier than the "safe" assets. And the more time you spend learning, the less risky they get.

Here are the "risky" income generating assets:

Asset #4: Dividend Paying Stocks

As I explained above, a dividend is a quarterly payment you receive for owning a percentage of a company, trust, or mutual fund based on the profits they make for that quarter.

Buying a stock means you're buying a small percentage of ownership in a company. If there are 100 stocks and you buy 1 of them, you own 1% of the company.

Dividend-paying stocks give you a passive income every quarter (every three months). These are known as "blue-chip stocks", and they tend to be able to weather most economic storms. (Notice I said "most", not "all"!)

Some of these stocks include:

- Many Precious Metals mining stocks

- Vanguard Dividend Appreciation Fund (VDAIX)

- Enterprise Products Partners (EPD)

Of course, these are just a few examples and not my recommendations of which you should invest in. Do your own research!

Asset #5: Property Rentals

When you think of rich people, you probably think of real estate. After all, real estate investment appreciation accounts for the highest number of millionaires out of any investment in the world!

But if you think it's just a matter of buying property, finding a tenant, and making fat paychecks every month, well... you're forgetting maintenance, repairs, and tenants who don't like to pay up.

It's not easy. But it can certainly pay off.

That said, given our current economic climate, I would NOT recommend real estate, especially to someone just starting out. And I might get a lot of flak for that from long-time professional investors.

Why?

Because A) a housing market crash is likely in the near future once mortgage forbearance wears off and B) real estate is a full-time job with a steep learning curve.

You don't just start buying property. There's a LOT of research that needs to go into it and a lot of work.

That said, I have not yet ventured into real estate investing so take my opinion with a grain of salt.

Asset #6: Peer-to-Peer Lending

Also known as “crowdlending,” peer-to-peer (P2P) lending allows investors to essentially act as a bank. You loan your money out to other people on a P2P lending platform (such as LendingClub), then they pay you back the money with interest later on.

While peer-to-peer lending can be lucrative with relatively high interest rates, keep in mind that you may be lending to people with a bad credit history and there's a chance they won't pay you back.

Asset #7: Creating Your Own Business

If you choose only one income generating asset from this list, I highly recommend this one!

Starting and growing your own business is the single most lucrative investment you can ever make. Not only from an ROI standpoint but also from what you will learn about how to make money and how money and finances work in the business world.

Related Reading: 21 Must-Read Personal Finance Reddit Posts

While most assets require a lot of capital to start making money, a business is one of the few that doesn't.

There are a lot of ways you can build a business in today's world, and some of them are very inexpensive, such as starting a blog. For less than $50 you can build a website and create an online asset that generates passive income, just like the one you're reading right now!

Some other options include:

- Freelancing (writing, coding, web design, transcribing, marketing... the list goes on.)

- Becoming a virtual assistant (helping businesses with writing, social media, email, etc.)

- Opening an eCommerce store

- Starting an Amazon FBA business

- Creating an online course

You'll notice these are all online businesses. Given the epidemic, starting a physical business right now is pretty risky and I wouldn't recommend it. But there are still some things you can do, such as dog sitting / babysitting / house sitting, starting an RV rental business, construction... you get the idea.

Head to the end of this guide if you're ready to start a business!

"Speculative" Assets

These last four assets are arguably not ACTUALLY assets because they don't produce anything. They make you money not by providing an income stream, but by going up in price over time.

This volatility in price makes them more speculative. Because while they can go up, they can also go down, which you obviously don't want. This means they are inherently higher risk than even the "risky" assets I listed above.

Let's take a look:

Asset #8: Real Estate & Land

You've probably heard about making a real estate investment to build wealth. Like your house, real estate or land CAN be a good investment... if you do your research and find property that will appreciate in value.

Unlike Real Estate Investment Trusts (REITs) or rental properties, no one is paying you to hold onto land or buildings. You need paying tenants for that.

However, if you buy a property or land and it appreciates in value because, say, the area is up-and-coming and being gentrified or something, then you can make money.

Personally, the only way I would buy land or real estate is if it was a large building renting to multiple tenants (these types of investments have excellent tax deductions because the government needs more of these kinds of properties) or if I was going to turn the property into an AirBNB rental.

Asset #9: Cryptocurrency

One of my absolute favorite investments right now is cryptocurrencies.

Of course, there's the obvious Bitcoin (BTC), but there are other coins worth looking into as well, such as Etherium (ETH), Cardano (ADA), and Chainlink (LINK), among many more.

Cryptocurrencies are a bit complicated, but I am confident you can understand them. They run on the blockchain and if I were to explain it like I was five, it basically works like this:

In order to get a bitcoin, you need to "mine" it using strong computers. Bitcoin miners use "ledgers", which are basically digital wallets, to store any bitcoin transactions. Every time someone transacts in bitcoin, every single ledger that exists confirms that transaction.

I know it may sound like mumbo-jumbo to some of you, but pretty much, cryptocurrencies are a way to store and exchange money without needing to go through a bank.

The reason I recommend investing in them is that many institutions believe they will be worth 5-20x what they are selling for today. In other words, most cryptocurrencies (particularly Bitcoin and Ethereum) are extremely undervalued today.

So if you buy a Bitcoin for $31,000 (the price as of January 11th 2021), by the end of the year, it may be worth $141,000 — a return of $110,000 or 450%!

That said, with high returns comes high risk. The price of bitcoin can fluctuate 20+% in a matter of hours. You could lose nearly all your money overnight if you're not careful. At the time of writing this, it went from $39k down to $30k and back up to $33k. This kind of investment is not for everyone!

Note: While buying Crypto by itself is technically not an asset, you can turn it into an asset by staking it. You're essentially lending your crypto in return for an interest rate. It's like the crypto version of peer-to-peer lending!

Asset #10: Precious Metals (Gold & Silver)

Similar to Bitcoin, precious metals are a store of value. They're more of an insurance policy against inflation than an asset. A way to avoid losing wealth.

While I don't recommend buying a lot of gold and silver, it's always good to have some in case the value of the dollar goes down (which it will).

Not much else to say here.

Asset #11: Stock Market

Finally, you might be thinking, "aren't stocks assets?"

Technically, no — not unless they pay dividends, like the ones we mentioned above.

If you buy a stock that doesn't pay dividends, you're not getting cash flow. You're buying low to (hopefully) one day sell high. Just like real estate, crypto, and precious metals.

If you're new to the stock market, investing in an index fund such as the S&P 500 is probably your best bet. Unless you want to spend most of your time studying stocks and learning how business works, an index fund will give you the most likely and easiest return.

But if you want to make bigger gains, investing in individual companies and/or ETFs is the way to go.

I am personally invested in industry-changing tech such as Tesla and ARK invest ETFs. They have the highest potential upside (in my opinion) out of all the types of stocks you can buy right now.

Again, I am just some guy on the internet — do not follow my word as gospel!

How to Build Assets Today: The Single Best Investment You Can Make

Now you know how to build assets. But what's the best way to make money on this list?

Simple: Investing in yourself and building a business that generates passive income.

As the famous investor Warren Buffet once said, "By far the best investment you can make is in yourself."

No one can take away what you've learned. Invest in learning skills (such as finance and business), and in the long-term, you'll get a much larger return than any individual asset!

This could mean buying a course, or reading books, or listening to podcasts. The resources are out there for you. You just have to use them.

Here are some resources I recommend:

- Rich Dad Poor Dad by Robert Kiyosaki (Learning How to Build Assets vs Liabilities)

- Ivan on Tech YouTube Channel (Bitcoin Investing)

- J Bravo YouTube Channel (Stock Investing / Swing Trading)

- Smart Passive Income (Guides on How to Start a Business)

And, of course, I share advice on how to make money, build assets, handle your finances, and start online businesses right here on my blog!

Click the button sign up for my newsletter and get more guides like this one: